0.8 Family economic situation

Reliance on income support is often associated with long-term poverty and social exclusion.

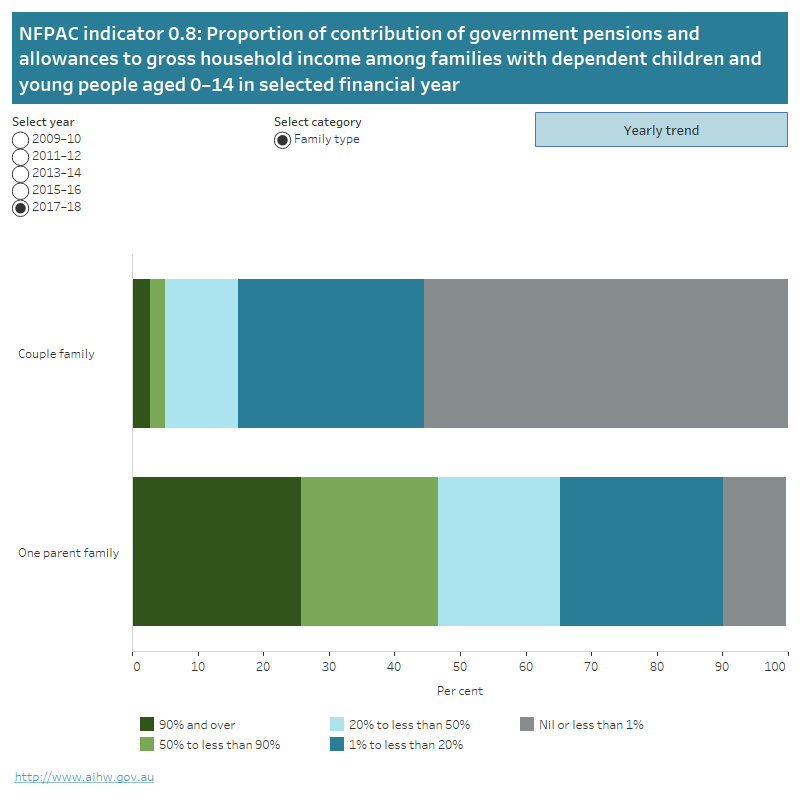

The extent and duration of income support varies across households; some receive income support for relatively short periods, while others are reliant for a longer duration. In general, the highest level of reliance is found among lone parents with dependent children, where childrearing responsibilities often limit their ability to gain employment.

In the data provided, 'contribution' refers to the contribution of government pensions and allowances to gross household income.

Trend data: For all indicator displays, the yearly trend is limited to indicators with 3 or more years (including the current year) of comparable time series data. To see the trend click on “Yearly Trend” button on the display. Where 3 or more years of comparable data including the most recent year is not available, a “No time series data” message is shown on the display.

The first figure is a horizontal bar graph showing the proportion of contribution of government pensions and allowance to gross household income among families with dependent children and young people aged 0–14 by family type (couple or one parent family). Data can be selected by year 2009–10 to 2017–18.

The second figure is a line graph showing the proportion of contribution of government pensions and allowances to gross household income among families with dependent children and young people aged 0–14 by family type (couple and one parent families) from 2009–10 to 2017–18.

Source: AIHW analysis of Australian Bureau of Statistics (ABS) Survey of Income and Housing

See the supplementary data tables for further information and footnotes about these data.

Indicator technical specifications

The information below provides technical specifications for the summary indicator data presented in the quick reference guide.

| Definition | Data source | |

|---|---|---|

| Numerator | Number of households with children aged 0-14 years where at least 50% of gross household income is from government pensions and allowances | ABS Survey of Income and Housing |

| Denominator | Number of households with children aged 0-14 years in the reference period | ABS Survey of Income and Housing |

Explanatory notes

Data from the ABS Survey of Income and Housing are collected from usual residents of private dwellings in urban and rural areas of Australia, excluding very remote areas.

Households are included where the youngest dependent child is aged 0–14 years.

Government pensions and allowances are income support payments from government to persons under social security and related government programs. Included are pensions and allowances that aged, disabled, unemployed and sick persons receive; payments for families and children, veterans or their survivors; and study allowances for students.