Government spending on health relative to taxation revenue

The ratio of government health spending to tax revenue provides a crude indication of the long-term sustainability of growth in health spending over time, particularly given the majority of health spending is by governments.

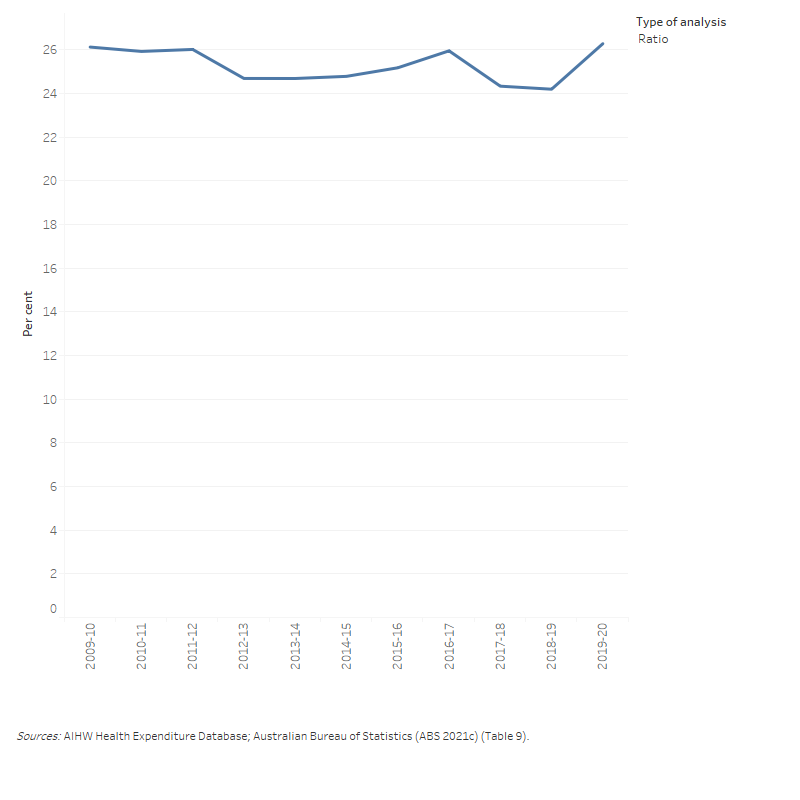

During 2019–20, spending on health by all governments was $142.6 billion, which represented 26.3% of government tax revenue (Figure 7). This was an increase from 2018–19, where the health spending to tax revenue ratio was 24.2%. and can be attributed to government health spending increasing by 7.0% while government tax revenue declined by 1.5% over 2019–20, in nominal terms – largely as a result of the COVID-19 pandemic.

Figure 7: Ratio of total health spending to government tax revenue, current prices, 2009–10 to 2019–20

The line graph shows that total government health spending and tax revenue increased from 2009–10 to 2019–20. Total government health spending increased from $84.8 billion in 2009–10 to $142.6 billion in 2019–20. Tax revenue was higher than total government health spending and increased from $324.7 billion in 2009–10 to $542.8 billion in 2019–20. During this period, total government health spending to tax revenue ratio ranged from 24.2 per cent to 26.3 per cent.

Tax revenue

Taxation revenue is a major source of income used by governments to fund public services, including health spending. The Australian Government raises revenue through taxing individuals and businesses, including through:

- personal income tax

- goods and services tax (GST), for which all revenue is distributed to states and territories

- company tax.

State and territory governments receive funds from the Australian Government, but also collect taxes, such as stamp duty on the purchase of a house or taxes on payrolls.

It should be noted that tax revenue is only one way that governments fund expenses and that tax rates vary over time and across the population. In that context, the government health spending to tax revenue ratio is only an indirect or crude measure of the sustainability of spending over the long term.